How to Master Psychology in Forex Trading

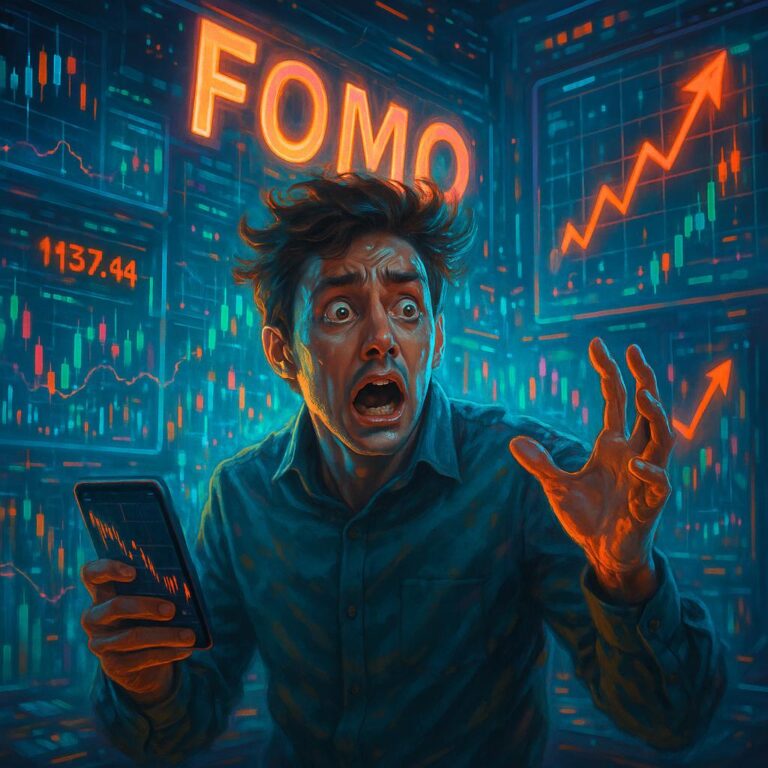

Mastering trading psychology is one of the most important yet overlooked skills in forex trading. Even with the best strategies, poor emotional control can ruin your performance. Here’s a clear guide to help you build strong trading psychology and improve your results in the forex market:

🧠 How to Master Psychology in Forex Trading

1. Understand the Role of Emotions

Emotions like fear, greed, overconfidence, and revenge trading are common in trading. The goal isn’t to eliminate emotions, but to manage them effectively.

2. Create and Follow a Trading Plan

A written trading plan helps you avoid emotional decisions by defining:

- Entry and exit rules

- Risk management (lot size, stop loss)

- Trading hours

- Strategy criteria

When you follow a plan, you reduce impulsive decisions.

3. Use Proper Risk Management

Never risk more than 1-2% of your capital per trade. Knowing that a single loss won’t destroy your account helps reduce anxiety and fear.

4. Accept That Losses Are Part of the Game

No strategy wins 100% of the time. Learn to accept losses without emotional reaction. Every professional trader has losing trades — what matters is how you manage them.

5. Keep a Trading Journal

Write down:

- Why you took a trade

- How you felt before/after the trade

- What you learned

Reviewing your journal helps you identify patterns of emotional mistakes and improve over time.

6. Avoid Overtrading

Taking too many trades out of boredom or frustration often leads to poor decisions. Discipline means waiting for high-probability setups, even if that means sitting on your hands.

7. Develop Patience and Discipline

These are core traits of successful traders:

- Patience to wait for your setup

- Discipline to stick to your strategy, even when tempted to chase the market

8. Stay Calm During Volatility

Fast-moving markets can trigger emotional reactions. Train yourself to stay calm, avoid panic, and focus on your trading rules.

9. Detach Your Identity From Results

Don’t let wins make you overconfident or losses affect your self-worth. Your identity is not your account balance. Focus on execution quality, not outcome.

10. Take Breaks and Maintain Balance

A clear, rested mind performs better. Don’t let trading take over your life. Exercise, sleep well, and maintain a life outside of trading.

✅ Final Advice

Mastering trading psychology takes consistent practice. Combine technical skill with emotional control, and you’ll gain the edge needed to become a confident, consistent trader.