The Psychology of a Trader: Mastering the Mental Game

When most people think of trading, they imagine charts, numbers, and technical analysis. But any seasoned trader will tell you — the real battlefield isn’t just on the screen; it’s in your mind. Understanding trader psychology is crucial for success, no matter your strategy or market.

Why Psychology Matters in Trading

Trading is as much an emotional game as it is a technical one. You can have the best strategy in the world, but if you can’t manage fear, greed, or impatience, you’ll likely sabotage your own results.

Emotions drive decision-making, and in the fast-moving world of trading, split-second decisions can make or break your day. This is why mental discipline often separates winning traders from the rest.

Common Psychological Traps

Here are a few psychological pitfalls traders often fall into:

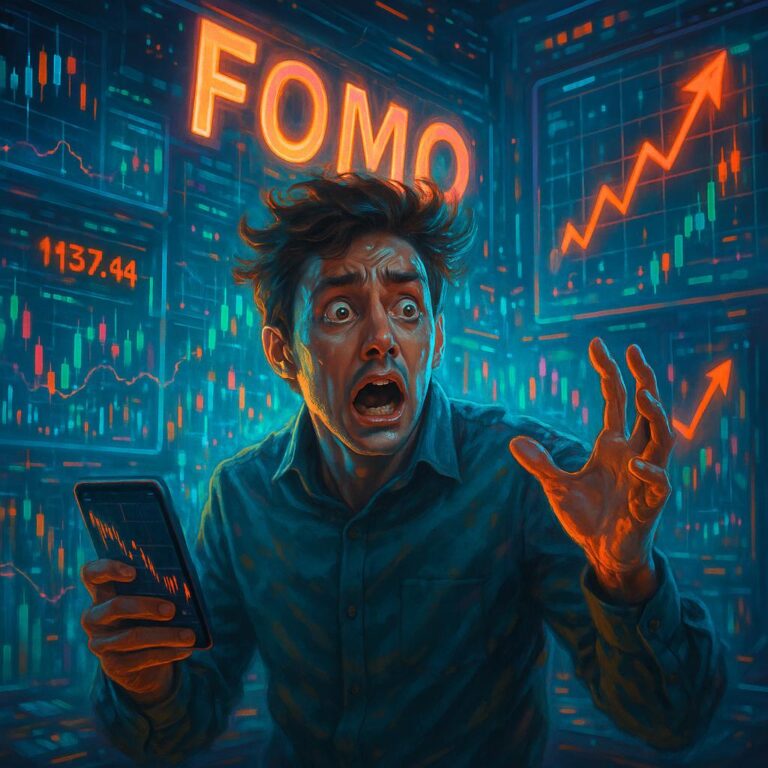

1. Fear of Missing Out (FOMO)

Chasing trades just because “everyone else is doing it” can lead to poor entries and unexpected losses. This fear is often driven by social media or news hype.

2. Overtrading

Feeling the need to be constantly in the market is usually a sign of emotional trading. Patience is a virtue — sometimes, the best trade is no trade at all.

3. Loss Aversion

Most people hate losing more than they enjoy winning. This can lead traders to hold onto losing positions too long, hoping the market will turn in their favor.

4. Revenge Trading

Trying to “win back” your losses quickly usually leads to even bigger losses. Emotional decision-making clouds your judgment and increases risk.

Key Traits of a Mentally Strong Trader

- Discipline: Following your plan even when your emotions beg you to do otherwise.

- Patience: Waiting for the right setup instead of forcing a trade.

- Self-Awareness: Recognizing emotional patterns and managing them before they affect your trades.

- Confidence (Not Ego): Trusting your analysis without overestimating your skills.

How to Improve Your Trading Psychology

- Have a Clear Plan: Know your entry, exit, and risk management rules before placing any trade.

- Journal Your Trades: Document not only the technical side of your trades but also your emotions during them. Over time, patterns will emerge.

- Set Realistic Expectations: Understand that losses are part of the game. The goal is consistency, not perfection.

- Take Breaks: If you’re feeling overwhelmed, step away. Mental clarity is key to smart decisions.

- Practice Mindfulness: Techniques like meditation or breathing exercises can help reduce stress and increase focus.

Final Thoughts

Mastering trading psychology won’t happen overnight, but it is one of the most powerful investments you can make in your trading journey. Remember: markets will always be uncertain, but your mindset doesn’t have to be.